In the world of Forex trading, mastering market structure and price action is essential for making informed trading decisions. These concepts form the foundation of technical analysis and help traders anticipate market movements, enhancing profitability. In this blog, we’ll dive deep into what market structure and price action mean, how they work together, and how you can apply them to improve your trading strategy.

What is market structure?

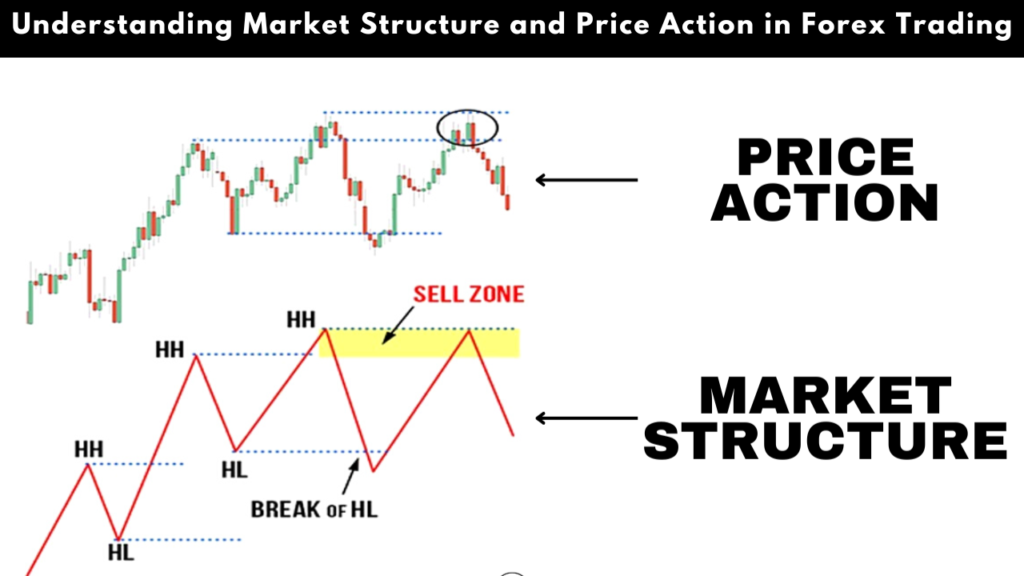

Market structure refers to the recurring patterns or behavior of price movements in financial markets. It helps traders identify trends, price levels, and potential reversal points. The market generally follows one of three trends:

- Uptrend (bullish market): characterized by higher highs and higher lows.

- Downtrend (Bearish Market): identified by lower highs and lower lows.

- Sideways market (range-bound market): occurs when price oscillates between two levels without forming a clear trend.

Key Elements of Market Structure:

- Highs and Lows: The peaks and troughs of price movements.

- Support and Resistance: Horizontal levels where price repeatedly reverses direction.

- Breakouts and Reversals: When price breaks a support or resistance level, signaling a potential trend change.

Understanding market struct allows traders to identify the current trend and predict the likelihood of its continuation or reversal.

What is Price Action?

Price action is the movement of a security’s price over time, represented visually on a price chart without relying on indicators. Traders analyze price action by studying candlestick patterns, chart formations, and key price levels. This method focuses on interpreting the behavior of price based solely on past price movements and patterns.

Key Elements of Price Action:

- Candlestick Patterns: These patterns, such as Doji, Engulfing, and Hammer, give clues about potential market direction.

- Price Levels: Identifying significant price levels where reactions (like reversals or consolidations) occur helps traders set entry and exit points.

- Trendlines and Channels: These can help visualize and trade within price trends.

How Market Structure and Price Action Work Together

By combining market struct and price action, traders can develop a holistic view of the market. Market structure provides the framework for understanding overall market conditions, while price action offers more detailed insights into real-time price movements.

Here’s how you can combine these tools:

- Trend Trading: Identify the current market struct to determine whether the market is in an uptrend, downtrend, or sideways movement. Use price action signals, like candlestick patterns, to time entries and exits.

- Support and Resistance Trading: Spot significant support and resistance levels through market structure analysis, then use price action (such as breakouts or reversals) to make your trading decisions.

- Reversals: Price action can confirm potential trend reversals identified by market structure, allowing for more accurate trades.

Practical Tips for Traders

- Start with Market Structure: Before making a trade, analyze the overall market structure to determine the prevailing trend or range.

- Use Price Action for Timing: Once the structure is clear, use price action patterns to identify ideal entry and exit points.

- Stay patient and disciplined: Both market structure and price action take time to develop. Waiting for clear signals increases your chances of success.

- Practice Makes Perfect: The more time you spend analyzing charts and studying these concepts, the more proficient you’ll become at identifying reliable trading opportunities.

Conclusion

Mastering market structure and price action can significantly elevate your trading game. By understanding how the market moves and reading price action, you can anticipate potential movements, enter trades with confidence, and improve your overall trading strategy. Both tools are indispensable for traders looking to minimize risk and maximize returns.