Understanding Forex Support and Resistance Levels

Introduction: In the world of Forex trading, mastering the concepts of support and resistance is crucial for making informed trading decisions. These levels act as psychological barriers for price movement and are used by traders to determine entry and exit points for their trades. Forex support and resistance in 2024 In this blog post, we’ll explore what support and resistance are, how to identify them, and strategies for using these levels effectively.

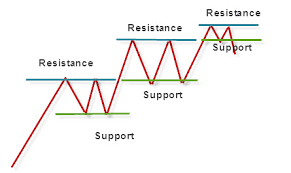

What is Support? Support is a price level where a downtrend can be expected to pause due to a concentration of demand. As the price of a currency pair declines towards a support level, buyers become more inclined to buy and sellers are less inclined to sell, creating a “floor” that prices have difficulty breaking through.

Example: If the EUR/USE pair is declining and reaches a price level where previously it has bounced back up, that price level is considered a support level.

What is Resistance? Resistance is the opposite of support. It is a price level where an uptrend can be expected to pause due to a concentration of supply. As the price of a currency pair rises towards a resistance level, sellers become more inclined to sell and buyers are less inclined to buy, creating a “ceiling” that prices struggle to break above.

Example: If the GBP/USD pair is rising and reaches a price level where previously it has reversed downwards, that price level is considered a resistance level.Forex support and resistance in 2024.

Identifying Support and Resistance Levels

- Historical Price Points: Look at the historical price data to identify levels where the price has consistently reversed direction.

- Moving Averages: These can act as dynamic support and resistance levels.

- Trendlines: Drawn by connecting a series of highs or lows, trendlines can indicate potential support or resistance levels.Forex support and resistance in 2024 .

- Fibonacci Retracement Levels: These levels are derived from the Fibonacci sequence and can indicate potential support or resistance zones.

Strategies for Using Support and Resistance:

- Range Trading: When a currency pair is trading within a range, buy near the support level and sell near the resistance level.

- Breakouts: If the price breaks through a support or resistance level, it can signal the start of a new trend. Traders might buy when resistance is broken and sell when support is broken.

- Pullbacks: After a breakout, the price often pulls back to the broken support or resistance level. Traders can enter a trade at this point, expecting the previous level to act as a new support or resistance.

Forex support and resistance in 2024

- Multiple Time Frames: Check support and resistance levels on multiple time frames to get a broader perspective.

- Volume Analysis: Higher trading volume near support or resistance levels can indicate stronger levels.Forex support and resistance in 2024 .

- Confirmation: Wait for confirmation of a breakout or pullback before entering a trade to avoid false signals.

Deep Dive into Forex Support and Resistance Levels

Advanced Techniques for Identifying Support and Resistance: While basic methods like historical price points and moving averages are effective, advanced techniques can provide deeper insights and higher accuracy.

- Pivot Points: Pivot points are calculated using the high, low, and closing prices of previous trading sessions. These points are used to predict potential support and resistance levels for the current session. Commonly used in day trading, pivot points can help identify key levels where price action is likely to occur.

- Candlestick Patterns: Specific candlestick patterns, such as hammer, doji, or engulfing patterns, near support or resistance levels can provide confirmation of potential reversals. These patterns indicate market sentiment and can validate the strength of a support or resistance level.

- Price Action: Analyzing the price action, such as the formation of higher highs and higher lows in an uptrend (or lower lows and lower highs in a downtrend), can help identify emerging support and resistance levels. This method relies on the trader’s ability to read and interpret raw price data without relying heavily on indicators.Forex support and resistance in 2024 .

- Confluence: Confluence occurs when multiple technical indicators or chart patterns point to the same support or resistance level. The convergence of these signals at a specific price level increases the reliability of that level, making it a stronger point of interest for traders.

Psychological Aspects of Support and Resistance: Support and resistance levels are not just technical constructs; they also reflect the psychological behavior of traders in the market.

- Market Sentiment: These levels are often self-fulfilling prophecies as many traders place their buy or sell orders around known support and resistance levels. When a large number of traders act on these levels, it reinforces the levels’ significance.

- Round Numbers: Traders often perceive round numbers (e.g., 1.2000 in EUR/USD) as significant psychological levels. These levels tend to act as strong support or resistance due to the clustering of buy or sell orders.Forex support and resistance in 2024.

- Market News and Events: Economic announcements, geopolitical events, and other news can temporarily override technical levels. Understanding the market context is crucial as news can lead to rapid shifts in support and resistance levels.

Strategies for Trading Support and Resistance

- Bouncing Strategy: This strategy involves placing trades based on the price bouncing off support or resistance levels. For instance, if the price is approaching a known support level, a trader might place a buy order anticipating a bounce back up.

- Breakout Strategy: Traders look for instances where the price breaks through a support or resistance level with increased volume. This breakout can indicate the start of a new trend. Traders might place orders in the direction of the breakout.

- Retest Strategy: After a breakout, prices often retest the broken support or resistance level. If the price retests and bounces back from this level, it provides a strong indication that the breakout was valid. Traders can place orders during this retest phase.

- False Breakout Strategy: Sometimes, the price breaks a support or resistance level but quickly reverses. These false breakouts can trap traders. Experienced traders look for confirmation before committing to a breakout trade to avoid such traps.

Tools and Indicators for Enhancing Support and Resistance Analysis

- Relative Strength Index (RSI): RSI can help identify overbought or oversold conditions near support and resistance levels. For example, if the price approaches a resistance level and the RSI is in overbought territory, it may suggest a potential reversal.Forex support and resistance in 2024

- Bollinger Bands: These bands help visualize volatility. When the price touches the upper or lower band at a known support or resistance level, it can indicate potential reversals or breakouts. http://WWW.FXPLANETS.COM.

- MACD (Moving Average Convergence Divergence): MACD can provide confirmation of potential breakouts or reversals at support and resistance levels. Divergence between MACD and price action can signal weakening trends.

Conclusion

Mastering the identification and application of support and resistance levels is essential for successful Forex trading. These levels offer critical insights into market dynamics and trader behavior. By combining traditional techniques with advanced strategies and psychological understanding, traders can develop robust trading plans. Continual practice, analysis, and staying informed about market conditions will further enhance the effectiveness of using support and resistance in trading.Whether you are a novice trader or an experienced one, understanding and utilizing support and resistance levels can significantly improve your trading performance and risk management.Forex support and resistance in 2024.